Perpetual trading records

Perpetual trading records

24h address transactions

Number of on-chain transactions for PERP in the last 24h.

Buying addresses : 177

Selling addresses : 227

24h fund data analysis

Comparison of fund inflow vs outflow for PERP, identifying the market momentum.

Inflow : $203,129

Outflow : $182,689

24h fund flow analysis

Type of players driving the momentum in PERP: Whales, dolphins or fish.

Buy : $189,528

Sell : $180,082

Large

$0 Buy

$0 Sell

Medium

$0

$0

Small

$189,528

$180,082

About Perpetual

Perpetual Protocol is a decentralized perpetual contract protocol that supports arbitrary assets, implemented through a virtual automated market maker (vAMM). Through the Perpetual Protocol, traders can trade directly through vAMM without the need for a counterparty. Through vAMM, if an asset has its price data on the chain-the perpetual data comes from Chainlink, Uniswap or other oracles-Perpetual Protocol can create it to create a perpetual contract belonging to the asset. In the near future, anyone can create a new contract market on the platform and cancel some transaction fees, just like the current liquidity provider on Uniswap. PERP is the native functional token of the platform, and has the following two purposes: Governance: Token holders can use their tokens to vote on the next asset to be listed, or to influence the development direction of the agreement. Pledge: Token holders can stake their tokens on the platform and receive staking rewards and part of the transaction fees. The collateralized tokens also have the right to protect the role of the market.

FAQ

News

Swap

What do you think of PERP today?

$1,701,131

PERP

8,335,664

WETH

274

WETH : PERP

1:30556.9

$4,833

PERP

21,049

WETH

0.8642

WETH : PERP

1:30556.9

$813

PERP

4,012

WETH

0.1299

WETH : PERP

1:30556.9

Type

Amount/Token

User

Top 10 coins

RNUT

RNUTFranklin's Girlfriend

SamanthaFranklin The Turtle

FranklinFranklin the Based Turtle

FRANKLINBINANCE JUNIOR APP

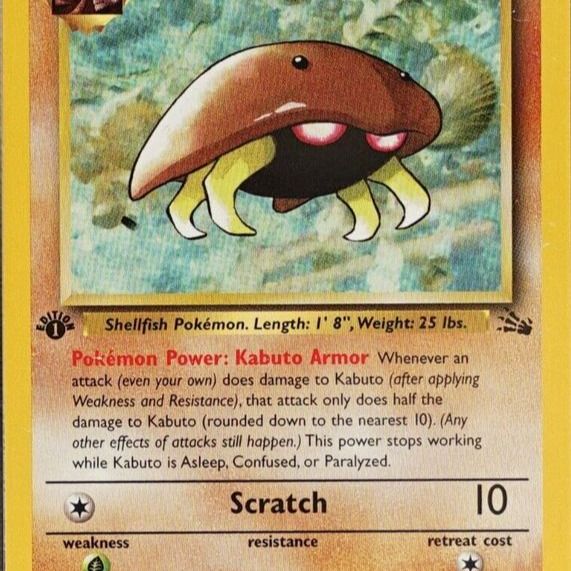

BINANCE JUNIORKabuto

KABUTOMubarakah

MubarakahSHITCOIN

SHITCOINBIG

BIGThe White Whale

WhiteWhaleLabels